All Categories

Featured

Table of Contents

The disadvantages of boundless financial are typically overlooked or not stated in any way (much of the info offered regarding this concept is from insurance coverage agents, which might be a little biased). Just the money value is expanding at the returns rate. You likewise need to spend for the cost of insurance policy, costs, and expenditures.

Every irreversible life insurance coverage plan is various, however it's clear somebody's general return on every dollar invested on an insurance coverage item could not be anywhere close to the returns price for the plan.

Infinite Banking Reviews

To offer a very standard and hypothetical example, let's presume a person is able to make 3%, on average, for every dollar they spend on an "infinite financial" insurance policy item (after all costs and fees). If we think those dollars would certainly be subject to 50% in taxes complete if not in the insurance coverage item, the tax-adjusted price of return could be 4.5%.

We think higher than typical returns on the entire life item and an extremely high tax obligation rate on bucks not put right into the policy (which makes the insurance product look much better). The reality for lots of folks might be even worse. This fades in contrast to the long-lasting return of the S&P 500 of over 10%.

Limitless financial is an excellent item for agents that market insurance coverage, but might not be ideal when contrasted to the less expensive choices (with no sales people earning fat compensations). Below's a failure of a few of the other purported benefits of boundless financial and why they may not be all they're broken up to be.

Rbc Infinite Private Banking

At the end of the day you are purchasing an insurance coverage item. We enjoy the security that insurance uses, which can be gotten much less expensively from a low-cost term life insurance policy policy. Overdue finances from the plan might additionally decrease your survivor benefit, diminishing another degree of defense in the plan.

The concept only works when you not just pay the substantial premiums, however utilize extra cash money to purchase paid-up additions. The opportunity expense of every one of those dollars is incredible extremely so when you could instead be investing in a Roth Individual Retirement Account, HSA, or 401(k). Even when contrasted to a taxed investment account or perhaps an interest-bearing account, limitless financial might not supply equivalent returns (compared to investing) and similar liquidity, gain access to, and low/no fee structure (contrasted to a high-yield interest-bearing accounts).

With the surge of TikTok as an information-sharing system, monetary guidance and strategies have actually located an unique method of dispersing. One such strategy that has actually been making the rounds is the infinite banking idea, or IBC for short, amassing recommendations from celebrities like rap artist Waka Flocka Flame. Nevertheless, while the approach is presently preferred, its roots trace back to the 1980s when economic expert Nelson Nash introduced it to the world.

Within these policies, the money worth expands based upon a rate established by the insurer. As soon as a considerable money worth collects, insurance holders can obtain a money worth loan. These finances vary from standard ones, with life insurance policy functioning as collateral, meaning one might shed their coverage if borrowing exceedingly without ample money worth to sustain the insurance policy costs.

Infinite Banking With Whole Life Insurance

And while the attraction of these policies is noticeable, there are inherent constraints and risks, necessitating thorough cash money value surveillance. The strategy's authenticity isn't black and white. For high-net-worth individuals or local business owner, particularly those making use of strategies like company-owned life insurance policy (COLI), the advantages of tax breaks and substance development might be appealing.

The appeal of limitless banking does not negate its challenges: Price: The fundamental requirement, a permanent life insurance policy policy, is pricier than its term counterparts. Eligibility: Not everyone receives whole life insurance coverage because of strenuous underwriting procedures that can exclude those with certain wellness or lifestyle problems. Complexity and threat: The complex nature of IBC, combined with its dangers, might hinder many, especially when simpler and much less dangerous alternatives are offered.

Alloting around 10% of your monthly earnings to the plan is just not feasible for a lot of people. Component of what you check out below is merely a reiteration of what has currently been said over.

So before you obtain right into a scenario you're not prepared for, know the complying with initially: Although the idea is typically offered as such, you're not really taking a car loan from on your own - infinite banking nash. If that were the situation, you wouldn't have to settle it. Instead, you're borrowing from the insurer and need to settle it with passion

Bioshock Infinite Bank Cipher Code Book

Some social media articles suggest utilizing money worth from entire life insurance coverage to pay down credit history card financial obligation. When you pay back the financing, a part of that rate of interest goes to the insurance coverage firm.

For the very first several years, you'll be paying off the commission. This makes it extremely challenging for your plan to gather worth during this time. Unless you can manage to pay a couple of to several hundred bucks for the following years or more, IBC will not work for you.

Not every person ought to count entirely on themselves for economic security. If you need life insurance, below are some important ideas to think about: Consider term life insurance policy. These policies provide coverage during years with significant monetary commitments, like mortgages, pupil financings, or when looking after children. See to it to look around for the very best price.

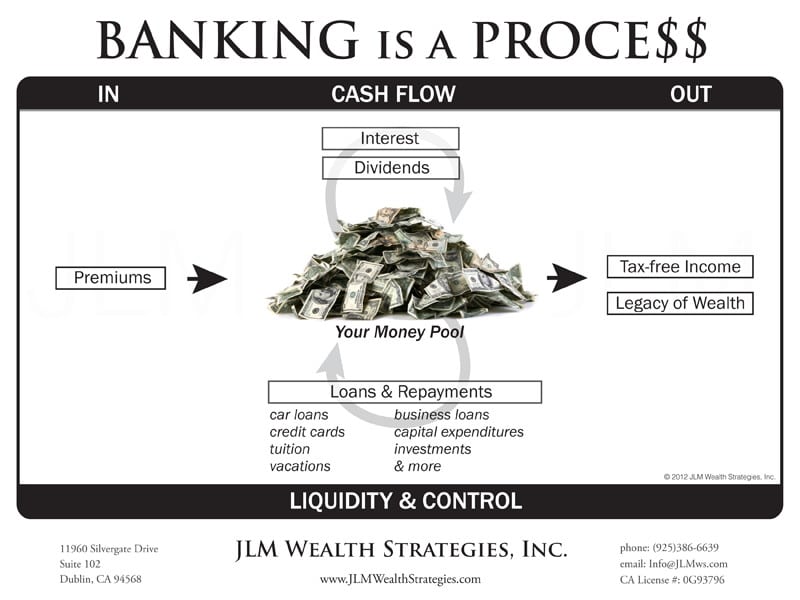

Boundless financial is not a services or product supplied by a certain organization. Boundless financial is a strategy in which you buy a life insurance policy policy that builds up interest-earning cash value and obtain lendings against it, "borrowing from on your own" as a resource of funding. Then ultimately pay back the financing and begin the cycle around again.

Pay policy premiums, a portion of which builds cash worth. Cash worth gains intensifying interest. Take a funding out versus the plan's money value, tax-free. Pay off finances with interest. Cash worth gathers once again, and the cycle repeats. If you utilize this idea as planned, you're taking money out of your life insurance policy plan to acquire everything you would certainly need for the remainder of your life.

Latest Posts

Bank On Yourself Life Insurance

How To Be Your Own Bank - Simply Explained - Chris Naugle

Becoming Your Own Banker